Momo Momentum

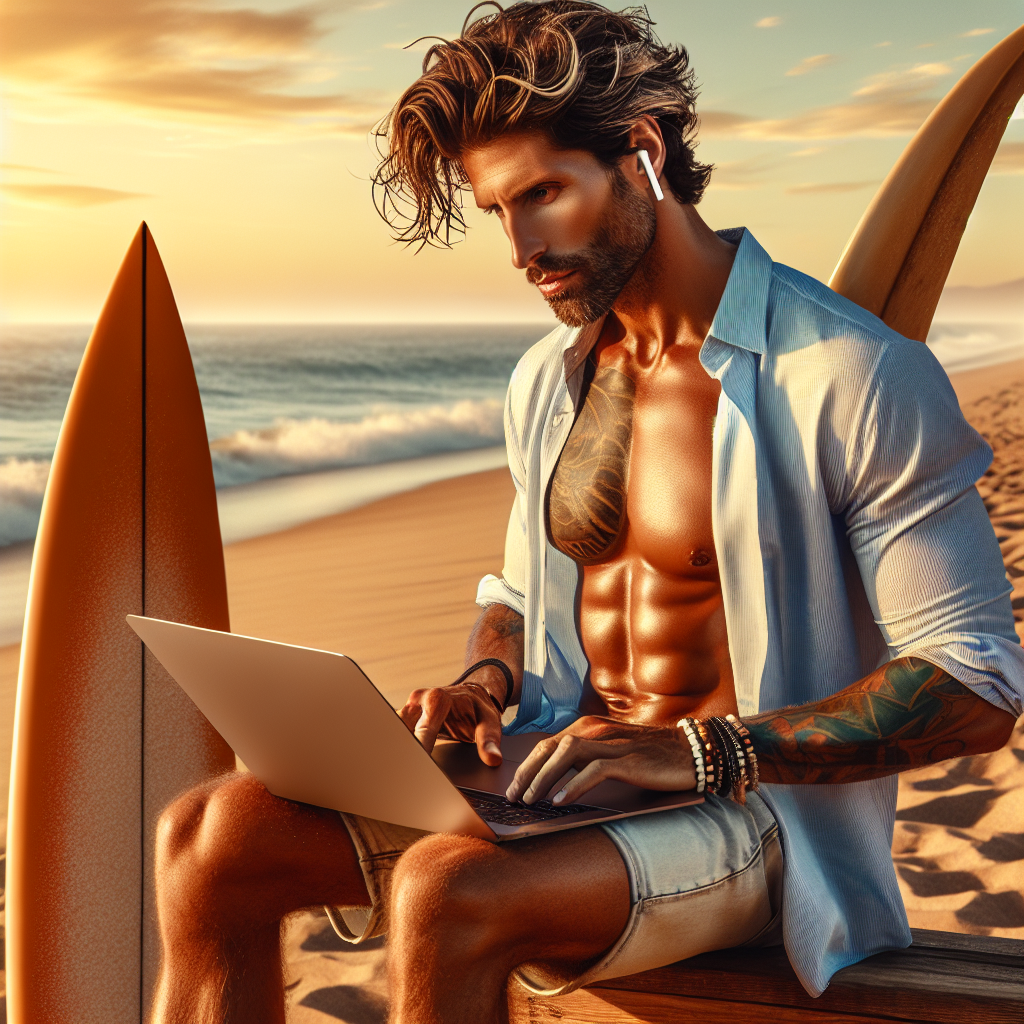

The Surfer

🏄 Swing Trader 📅 33 years old (Born 1993)"Objects in motion stay in motion. I don't fight physics."

Perpetual tan, salt-crusted hair. Trades from a laptop on various beaches. Has "Momentum > Fundamentals" tattooed on his forearm in binary code.

📊 Last Month Performance: Showing Momo Momentum's performance over the last month across 12 crypto symbols. 🟢 LIVE

Quick Performance Comparison

Click any period to view detailed stats

Equity Curve (Last Month)

Combined P&L across all 12 symbols

💰 Trading Activity (Last Month)

⚙️ Trading Strategy

20-day momentum, 5% threshold confirmation

Looks for stocks that have gained 5%+ over the last 20 days. Enters on pullbacks (red candles) within the uptrend and rides until target hit or momentum fades.

🎯 Best Suited For

Growth stocks, meme stocks

📜 Why This Strategy Works

Momentum persists because of behavioral biases. Investors underreact to good news initially, then pile in as the trend becomes obvious. Momo catches the middle of this wave.

Mathematical Formula

CODE VERIFIED —

These formulas are extracted directly from the simulation engine and verified against the source code.

Source: scripts/run-*-simulation.php

📊 Entry Signal

📈 Entry Signal

📉 Exit Rules

⚙️ Simulation Parameters

📖 Historical Origin

Origin: Jegadeesh & Titman's landmark momentum paper

In 1993, Jegadeesh and Titman published "Returns to Buying Winners and Selling Losers." Their data was irrefutable: stocks that performed well over 3-12 months continued to outperform.

🏆 Top 10 Performing Symbols (Last Month)

📉 Worst 5 Performing Symbols (Last Month)

📊 All Symbol Results

Click on any row to see detailed trade history with equity curve

| Rank | Symbol | Return | 1M Start | Final Value | Trades | Win Rate | Fees | Net | Max DD | Avg Hold | Refunds | Last Refund |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 |

LTCUSD ₿

LTCUSD ₿

|

+0.00% | $2,848 | $2,848 | NO ENTRY | - | $3,184 | - | -80.3% | 4.2d | ✓ | - |

| 2 |

BTCUSD ₿

BTCUSD ₿

|

-8.54% | $11,492 | $10,511 | 1 | 0% | $1,936 | -$981 | -47.6% | 11.0d | ✓ | - |

| 3 |

AVAXUSD ₿

AVAXUSD ₿

|

-9.40% | $3,406 | $3,086 | 1 | 0% | $3,891 | -$320 | -79.6% | 3.3d | ✓ | - |

| 4 |

LINKUSD ₿

LINKUSD ₿

|

-16.47% | $3,092 | $2,583 | 2 | 0% | $3,463 | -$509 | -82.2% | 3.4d | ✓ | - |

| 5 |

ETHUSD ₿

ETHUSD ₿

|

-16.48% | $12,918 | $10,789 | 2 | 0% | $2,945 | -$2,129 | -51.4% | 6.3d | ✓ | - |

| 6 |

SHIBUSD ₿

SHIBUSD ₿

|

-16.51% | $11,488 | $9,592 | 2 | 0% | $27,599 | -$1,897 | -89.5% | 2.4d | ✓ | - |

| 7 |

XRPUSD ₿

XRPUSD ₿

|

-16.54% | $9,010 | $7,519 | 2 | 0% | $7,354 | -$1,490 | -76.6% | 3.7d | ✓ | - |

| 8 |

SOLUSD ₿

SOLUSD ₿

|

-16.91% | $9,471 | $7,870 | 2 | 0% | $6,109 | -$1,602 | -62.3% | 4.6d | ✓ | - |

| 9 |

DOTUSD ₿

DOTUSD ₿

|

-17.20% | $4,629 | $3,833 | 2 | 0% | $4,043 | -$796 | -76.0% | 3.3d | ✓ | - |

| 10 |

DOGEUSD ₿

DOGEUSD ₿

|

-19.16% | $12,684 | $10,254 | 2 | 0% | $11,304 | -$2,430 | -66.7% | 2.3d | ✓ | - |

| 11 |

PEPEUSD ₿

PEPEUSD ₿

|

-23.97% | $34,061 | $25,896 | 5 | 20% | $107,404 | -$8,164 | -85.4% | 1.2d | ✓ | - |

| 12 |

UNIUSD ₿

UNIUSD ₿

|

-24.20% | $3,021 | $2,290 | 5 | 0% | $6,276 | -$731 | -83.6% | 2.6d | ✓ | - |

👤 Personality

Lives for the rush. Talks fast, thinks faster. Gets bored if a trade takes more than a week. Has ADHD but considers it a trading advantage.