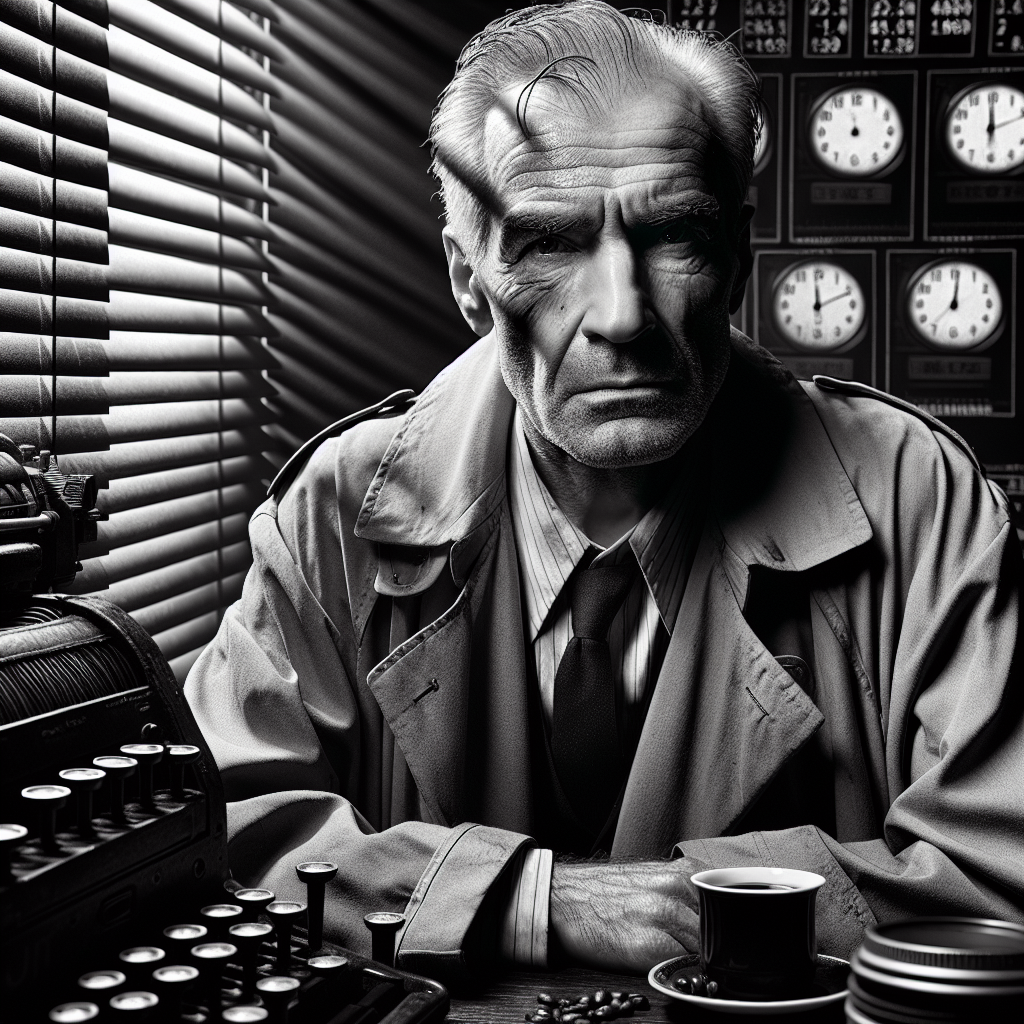

Victor Volume

The Detective

🔍 Swing Trader 📅 96 years old (Born 1930)"Price is what they show you. Volume is what they're actually doing."

Elderly detective in his 90s—rumpled trench coat, coffee stains, sharp watchful eyes that miss nothing. Old ticker tape machines sit next to modern screens.

📊 Year to Date Performance: Showing Victor Volume's performance over the year to date across 12 crypto symbols. 🟢 LIVE

Quick Performance Comparison

Click any period to view detailed stats

Equity Curve (Year to Date)

Combined P&L across all 12 symbols

💰 Trading Activity (Year to Date)

⚙️ Trading Strategy

2x volume spike + price movement = institutional entry

Looks for 2x normal volume combined with price movement—this combination signals that big players are making moves. Follows their lead.

🎯 Best Suited For

Finding accumulation before breakouts

📜 Why This Strategy Works

Institutions can't hide. When they accumulate, volume spikes—they're simply too big to be subtle. Retail follows smart money.

Mathematical Formula

CODE VERIFIED —

These formulas are extracted directly from the simulation engine and verified against the source code.

Source: scripts/run-*-simulation.php

📊 Entry Signal

📈 Entry Signal

📉 Exit Conditions

⚙️ Simulation Parameters

📖 Historical Origin

Origin: Richard Wyckoff's Composite Man theory

Richard Wyckoff spent decades studying how "Composite Man" moved markets. His insight: big players could manipulate price, but they couldn't hide their volume.

🏆 Top 10 Performing Symbols (Year to Date)

📉 Worst 5 Performing Symbols (Year to Date)

📊 All Symbol Results

Click on any row to see detailed trade history with equity curve

| Rank | Symbol | Return | YTD Start | Final Value | Trades | Win Rate | Fees | Net | Max DD | Avg Hold | Refunds | Last Refund |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 |

SHIBUSD 🚫 PROBATION

₿

SHIBUSD 🚫 PROBATION

₿

|

+5.33% | $10,099 | $10,637 | 5 | 40% | $277 | +$538 | -99.5% | 1.5d | 1 |

Feb 6, 2026 22d left |

| 2 |

DOGEUSD 🚫 PROBATION

₿

DOGEUSD 🚫 PROBATION

₿

|

-0.46% | $10,099 | $10,052 | 5 | 40% | $252 | -$46 | -105.6% | 1.3d | 1 |

Feb 5, 2026 21d left |

| 3 |

PEPEUSD ₿

PEPEUSD ₿

|

-28.18% | $160 | $115 | 39 | 33% | $65,405 | -$45 | -99.9% | 19.1h | ✓ | - |

| 4 |

XRPUSD ₿

XRPUSD ₿

|

-28.91% | $4,757 | $3,381 | 20 | 25% | $15,416 | -$1,375 | -83.8% | 2.0d | ✓ | - |

| 5 |

BTCUSD ₿

BTCUSD ₿

|

-31.39% | $7,316 | $5,020 | 12 | 17% | $7,739 | -$2,297 | -66.7% | 4.9d | ✓ | - |

| 6 |

LINKUSD ₿

LINKUSD ₿

|

-33.95% | $363 | $240 | 19 | 21% | $7,527 | -$123 | -98.2% | 1.6d | ✓ | - |

| 7 |

SOLUSD ₿

SOLUSD ₿

|

-34.47% | $880 | $577 | 17 | 24% | $7,578 | -$303 | -95.8% | 1.8d | ✓ | - |

| 8 |

DOTUSD ₿

DOTUSD ₿

|

-35.96% | $196 | $125 | 24 | 25% | $6,140 | -$70 | -99.0% | 1.7d | ✓ | - |

| 9 |

AVAXUSD ₿

AVAXUSD ₿

|

-36.41% | $172 | $109 | 16 | 19% | $7,626 | -$63 | -99.1% | 1.5d | ✓ | - |

| 10 |

UNIUSD ₿

UNIUSD ₿

|

-40.28% | $700 | $418 | 24 | 17% | $9,515 | -$282 | -98.0% | 1.5d | ✓ | - |

| 11 |

LTCUSD ₿

LTCUSD ₿

|

-41.02% | $914 | $539 | 16 | 19% | $7,670 | -$375 | -96.1% | 2.1d | ✓ | - |

| 12 |

ETHUSD ₿

ETHUSD ₿

|

-52.87% | $3,368 | $1,587 | 28 | 18% | $8,021 | -$1,781 | -89.5% | 2.9d | ✓ | - |

👤 Personality

Paranoid but productive. Sees patterns everywhere. Believes the smart money leaves fingerprints if you know where to look.